|

|

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

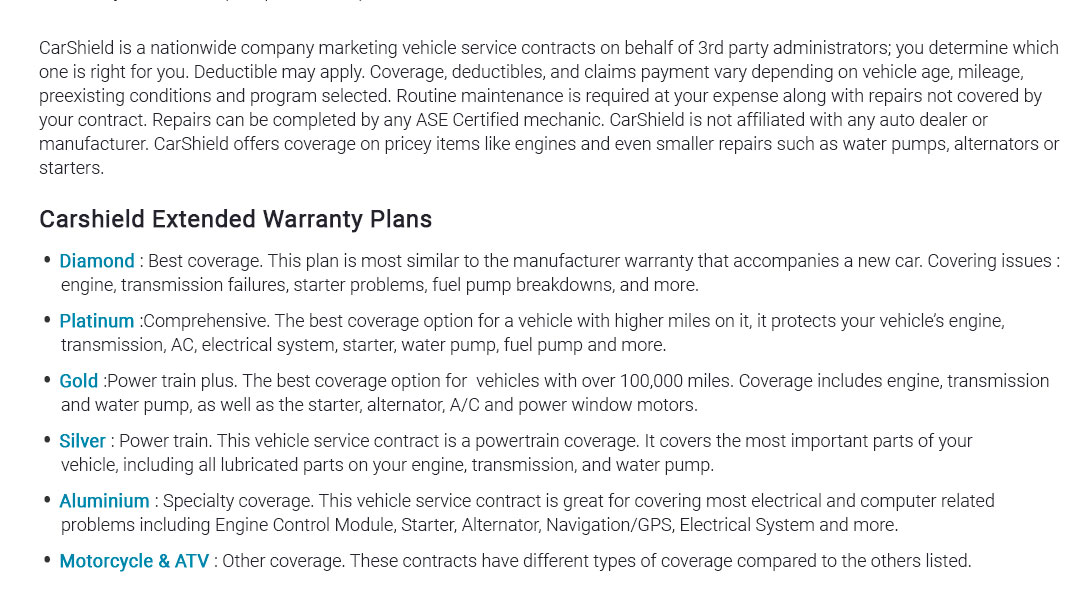

Understanding Auto Mechanic Insurance: A Comprehensive GuideThe realm of auto mechanic insurance, a niche yet vital segment of the broader insurance industry, has garnered significant attention among professionals seeking to safeguard their businesses against potential risks. As vehicles become increasingly sophisticated, the responsibilities placed upon auto mechanics grow correspondingly complex, underscoring the importance of having a robust insurance policy tailored to their unique needs. This guide seeks to explore the nuances of auto mechanic insurance, offering practical advice while weighing its advantages and disadvantages. At its core, auto mechanic insurance is designed to protect professionals in the automotive repair industry from various liabilities and operational risks. The standard coverage typically includes general liability, property damage, and business interruption insurance. Each component serves a distinct purpose, collectively ensuring that a business can withstand unforeseen events. General liability insurance, for instance, covers costs associated with third-party bodily injury or property damage that might occur within the workshop premises. This form of coverage is essential in a bustling environment where tools, machinery, and vehicles constantly intermingle, raising the likelihood of accidental mishaps. On the other hand, property damage insurance focuses on protecting the physical assets of the business, including tools, equipment, and the premises itself. In an industry where the value of equipment can run into thousands of dollars, the risk of theft, fire, or natural disasters poses a significant threat. Business interruption insurance, meanwhile, plays a pivotal role in maintaining financial stability during periods when operations are halted due to covered incidents. By compensating for lost income, this coverage ensures that businesses can continue to meet their financial obligations without undue strain. Despite the apparent benefits, it is important to recognize the potential drawbacks of auto mechanic insurance. One primary concern often cited by business owners is the cost. Premiums can be substantial, particularly for small or newly established workshops with limited financial resources. Moreover, navigating the intricacies of insurance policies can be daunting, especially for those unfamiliar with industry jargon or complex legal terms. As such, enlisting the services of an experienced insurance broker can be invaluable in selecting a policy that strikes the right balance between comprehensive coverage and affordability. Furthermore, understanding the specific exclusions and limitations of a policy is crucial. Certain incidents, such as those arising from employee negligence or deliberate misconduct, may not be covered, leaving businesses vulnerable to costly lawsuits. This reality underscores the importance of implementing rigorous safety protocols and ensuring that employees are adequately trained and aware of best practices. Additionally, regular policy reviews are advisable to ensure that coverage remains aligned with the evolving needs of the business.

In conclusion, while the investment in auto mechanic insurance may seem burdensome at first glance, its long-term benefits often outweigh the costs. By providing a safety net against the myriad challenges inherent in the automotive repair industry, such insurance fosters resilience and sustainability. Ultimately, the decision to procure auto mechanic insurance should be informed by a careful assessment of individual business needs, risk exposure, and financial capacity. As the adage goes, it is better to have it and not need it than to need it and not have it, a sentiment that aptly applies to the prudent management of risks in any enterprise. https://www.thehartford.com/business-insurance/auto-repair-shop

From fixing cars to performing regular maintenance, you need an auto mechanic insurance policy that keeps you covered. Get the protection you can count on for ... https://www.farmers.com/business/industry/auto-service-repair/

Auto repair shop insurance from provides customized policies for large & small auto service garages and mechanics. Click to learn more or get a free quote. https://www.western-insurance.net/industries-served/auto-repair-shop-insurance-california

The cost of auto repair insurance varies depending on factors such as the size of your business, location, and the specific coverage options you choose. On ...

|